RBI gave a blow to the common man! Repo rate hiked by 0.50 percent, loan becomes expensive - your EMI will increase

RBI Governor has expressed concern over rising inflation. RBI Governor said that inflation is increasing continuously. Inflation has increased due to supply problems due to the war. After the Kovid epidemic, the RBI will continue to take steps to give a boost to the economy.

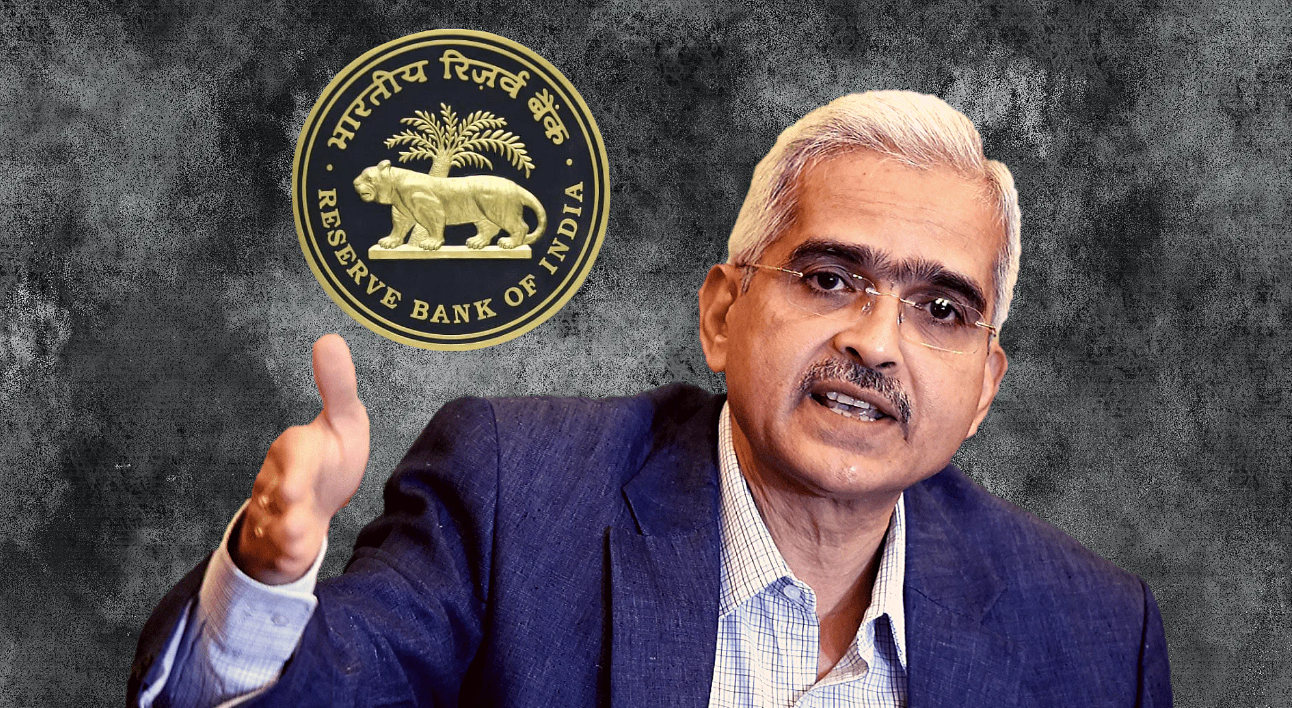

Reserve Bank of India i.e. RBI has given another blow to the common man. RBI Governor Shaktikanta Das has announced an increase of 50 basis points in the repo rate. Das has said that the repo rate has been increased from 4.40 percent to 4.90 percent. Governor Shaktikanta Das has made this announcement after the monetary policy meeting of RBI.

That is, now the repo rate has increased by 90 basis points in a month. After this decision of RBI, from home loan to car loan and education loan, it is sure to be expensive. On the other hand, those who have already taken a home loan, their EMI will become more expensive.

RBI Governor has expressed concern over rising inflation. After the Kovid epidemic, the RBI will continue to take steps to give a boost to the economy. He has said that there has been a slowdown in global economic activity and pace and its effect is being seen on the Indian markets as well. The pressure of inflation is increasing in the country. There is also a decrease in the commodity market. The rule book on monetary policy does not work.